As international teachers, one thing we often share is a love of travel and learning about new cultures. There is no feeling quite like moving to a new country and getting to know the local sights, language and traditions. However, as exciting as life overseas may be, it comes with its fair share of challenges. From dealing with language barriers, to adapting to different lifestyles, there are many times when it can feel a little overwhelming. Managing your finances can also be another challenge that you may face at some point on your international teaching journey.

Have you ever tried to pay for something using a debit card whilst abroad or transferred money between international accounts, only to take a look at your bank account and realise it’s much more than what you were expecting? It is not uncommon to be charged additional fees by your bank, sometimes these can even be hidden and made unclear.

During my time teaching abroad, one of my main goals was to save money; I would often transfer money back to my home account in the UK at the end of each term. The ideal scenario would have been to send some back each month as this would have helped me be more organised with my finances, however, I soon noticed that for each transfer I made, I would get charged around £16 (almost 22 USD)! As you can imagine, it was a frustrating experience, especially as I’d worked hard to save money and felt like so much of it was being lost.

If you’re looking to avoid similar situations, the good news is that there are ways around it! When I was living abroad, I was unaware that platforms like Wise existed – but now we’re here to share these helpful tips with you to make your international experience much smoother. Wise, our trusted partner, offers a clear, cost-effective solution for sending money across borders. Keep on reading to find out more! ⬇️

So why choose Wise to help you out?

Easy! Here are the top 4 reasons:

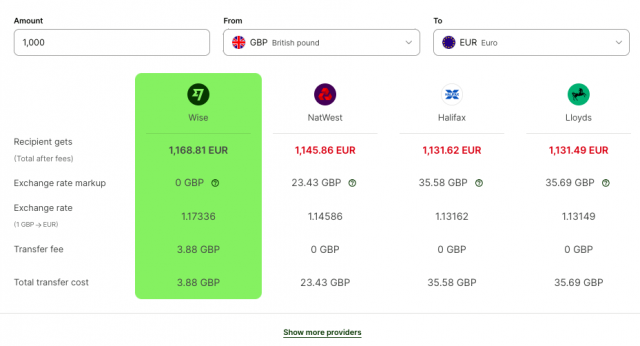

- Price: Wise is up to 8 times cheaper than traditional banks for international transfers. It uses the real mid-market exchange rate and charges low, upfront fees so that you can avoid any post-spending surprises when checking your bank account.

If you’re feeling a little skeptical and would like to find out more, you can use the embeddable calculator widget or the price comparison table on the Wise website to compare how much you can save with Wise versus traditional banks.

- Safety: Your money is in safe hands. Wise is fully regulated by financial authorities in every country where it operates, just like a traditional bank.

- Speed: Even if you need to send money quickly, you can rest assured as 55% of transfers with Wise arrive instantly. 76% of all transfers arrive within an hour and 93% within a day!

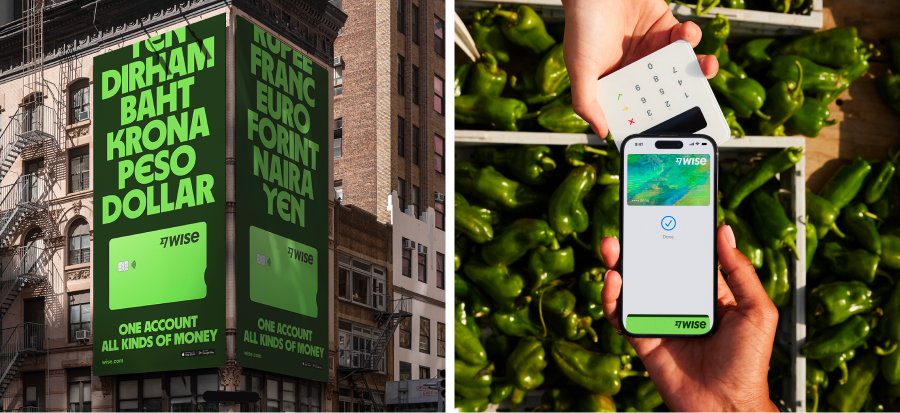

- Global reach: Wise allows customers to hold, spend and send money in over 40 different currencies. This means you can manage your finances regardless of where you are in the world which is just what every international teacher needs! 🌍

Doesn’t that sound amazing?

While all of these are perks that come along with simply opening a Wise account, there are also several other services offered alongside it. Let’s explore in more detail!

What kind of products and services does Wise offer?

- Wise Account

The Wise Account allows you to hold and manage money in multiple currencies. This account is perfect for people who want to make international transactions with ease, whether for personal use or business.

Creating an account can easily be done in just a few minutes! Why not try it out yourself by clicking the link below?

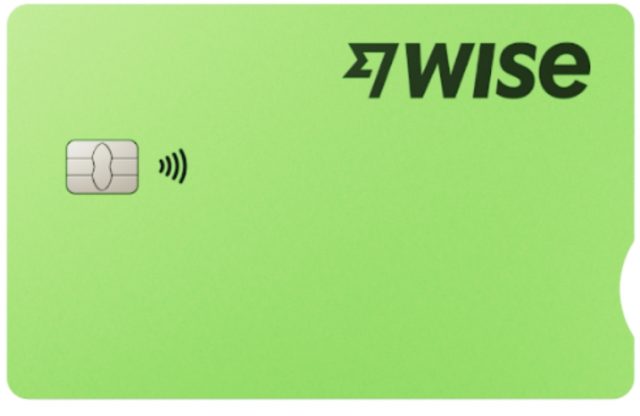

- Wise Debit Card

Wise offers a debit card that makes spending money overseas easier, whether you have made the move or are simply on holiday. It lets you spend in any currency at the real exchange rate with no hidden fees. Plus, you can use it to withdraw cash from ATMs worldwide whilst avoiding the expensive charges.

- Wise Travel Card

The Wise Travel Card is a great option if you’re going abroad. This prepaid card allows you to load multiple currencies and pay with ease. It’s like having a local bank account whilst travelling, but with none of the high fees that come with using a traditional bank card internationally.

This one has become a personal staple for me now any time I travel overseas. Long gone are the days of having to withdraw a lot of cash in one go, while having to estimate how much you will need for your trip. The Travel Card can easily be topped up through the Wise app and means you can make the most out of your travels without having to worry about facing high charges after each use.

- Wise for Business

For businesses that deal with international transactions, Wise for Business is the perfect solution. It provides the same great features as the Wise account but with added tools for invoicing, mass payments and managing business expenses across borders.

- Wise Large Transfers

When transferring large amounts of money, Wise offers discounted pricing to help you save even more. This makes Wise an excellent choice for anyone who needs to send substantial amounts internationally, such as business owners, investors or people buying property abroad.

- Wise Interest & Wise Interest for Business

Wise now offers interest-earning accounts for individuals and businesses, allowing you to earn interest on your balances. It’s available in select countries (including the UK, EU, and the US) and offers a safe and easy way to grow your money while it’s just sitting in your account!

How to open a Wise account and make an international transfer

So, you’re thinking of opening a Wise account? Great idea! 😄

The best part is that it is super easy! Here’s how to do it:

- Open an account on Wise by clicking here.

- Verify your identity (you’ll need some ID for this).

- Add your money to the account in your local currency.

- Set up your transfer, choose the recipient, and confirm the payment.

Wise will show you the exact fees and exchange rates before you confirm, so you know exactly what you’re getting.

Once you’ve completed those first steps, you’re good to go! Get ready to travel and send money knowing you’re in good hands. 💸

Why Wise is a smart move for your money

If you’re sending money overseas, getting paid from another country or just want to avoid ridiculous bank fees, Wise has your back. It’s fast, secure and way more affordable than regular bank transfers.

With real exchange rates, no sneaky fees and tools that suit everyone from freelancers to frequent flyers, Wise makes managing money across borders simple and stress-free so that your salary can stretch even further.